All Categories

Featured

That's not the very same as spending. So, be mindful of that. They will certainly not just desire you to get the product, they desire you to go into organization with them, join their group. Well, below's a sign of things to come. Ask yourself, has this person who's selling this item to me been doing this for five years or at the very least ten thousand hours' well worth of services? If the response is no, then you are probably on their listing of a hundred to three hundred individuals that they had to make a note of that are good friends and household that they're currently pitching within their network circle.

I desire you to be an expert, a master of all the knowledge required to be a success. Do not, Manny, if you do this, don't call a pal or family for the first five years. And afterwards, incidentally, you desire to ask them that in the meeting.

Equity Indexed Life

I indicate, that's when I was twenty-something-year-old Brian being in his money course, and I was browsing, going, 'What do these people do after they graduate?' And all of them go help broker-dealers or insurance coverage companies, and they're offering insurance coverage. I relocated over to public accounting, and currently I'm all excited because every moms and dad is typically a CPA that has a youngster in this night.

That's where knowledge, that's where expertise, that's where knowledge originates from, not even if somebody loves you, and currently you're gon na go transform them right into a client. For more details, look into our free resources.

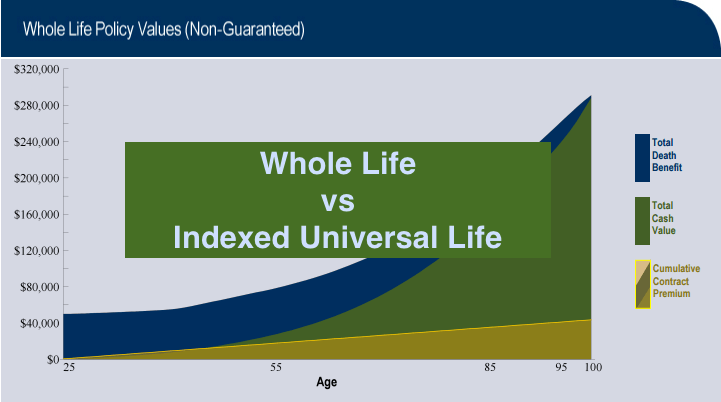

For as long as I've been handling my very own funds, I've been hearing that individuals must "buy term and invest the distinction." I have never really taken supply in the principle. I suggest, I am a monetary services specialist that reduced her teeth on whole life, yet who would certainly adopt this theory centered around acquiring only term life insurance policy? Provided, term is an economical kind of life insurance coverage, but it is likewise a temporary sort of insurance coverage (10, 20, three decades max!).

It ensures that you have life insurance coverage beyond thirty years despite how much time you live, actually and depending on the sort of insurance policy, your costs amount might never ever transform (unlike renewable term plans). There is that entire "invest the difference" point. It really rubs me the incorrect way.

Keep it actual. If for no various other factor than the reality that Americans are awful at conserving cash, "acquire term and invest the difference" ought to be outlawed from our vocabularies. Hold your horses while I go down some knowledge on this factor: According to the United State Social Safety Administration, the ordinary American's yearly wage was $42,979.61 in 2011; Yet, only 14.6 percent of American households had liquid properties of $50,000 or more throughout that same duration; That means that much less than 1 in 4 households would have the ability to replace one income-earner's earnings should they be jobless for a year.

Enjoy closelyHave you ever before researched how indexed universal life (IUL) insurance policy practically works? It is a kind of cash money worth life insurance policy that has an adaptable costs settlement system where you can pay as much as you would certainly such as to develop up the money worth of your policy a lot more rapidly (subject to specific limitations DEFRA, MEC, TEFRA, etc).

Latest Posts

Iul L

Best Iul Policies

Financial Foundation Iul