All Categories

Featured

That's not the very same as investing. Be mindful of that. They will certainly not just desire you to purchase the item, they desire you to enter into organization with them, join their group. Well, here's a cautionary tale. Ask yourself, has this person who's marketing this item to me been doing this for 5 years or a minimum of 10 thousand hours' well worth of services? If the response is no, then you are most likely on their checklist of a hundred to 3 hundred individuals that they needed to jot down that are loved ones that they're currently pitching within their network circle.

I want you to be a specialist, a master of all the expertise required to be a success. Do not, Manny, if you do this, don't call a friend or family members for the initial five years. And then, incidentally, you wish to ask them that in the meeting.

Index Life Insurance Pros And Cons

I indicate, that's when I was twenty-something-year-old Brian sitting in his finance class, and I was browsing, going, 'What do these individuals do after they graduate?' And all of them go job for broker-dealers or insurance policy companies, and they're offering insurance coverage. I conformed to public audit, and now I'm all excited due to the fact that every parent is typically a CPA that has a youngster in this evening.

That's where knowledge, that's where expertise, that's where experience originates from, not just because someone enjoys you, and currently you're gon na go transform them right into a customer. For even more information, take a look at our cost-free sources.

For as long as I have actually been handling my very own finances, I've been listening to that individuals should "purchase term and invest the difference." I have never ever truly taken stock in the idea. I mean, I am a monetary solutions professional that reduced her teeth on entire life, but that would certainly embrace this theory focused around buying only term life insurance policy? Provided, term is an affordable kind of life insurance, yet it is additionally a short-lived kind of protection (10, 20, 30 years max!).

It makes sure that you have life insurance coverage past thirty years no matter how long you live, as a matter of fact and relying on the kind of insurance, your premium quantity might never ever alter (unlike renewable term policies). Then there is that entire "spend the distinction" point. It truly scrubs me the wrong means.

Maintain it actual. If for nothing else factor than the fact that Americans are terrible at conserving money, "purchase term and spend the distinction" should be prohibited from our vocabularies. Be person while I drop some understanding on this factor: According to the United State Social Safety And Security Management, the average American's annual wage was $42,979.61 in 2011; Yet, just 14.6 percent of American family members had fluid assets of $50,000 or even more during that exact same period; That implies that much less than 1 in 4 families would be able to replace one income-earner's salaries ought to they be jobless for a year.

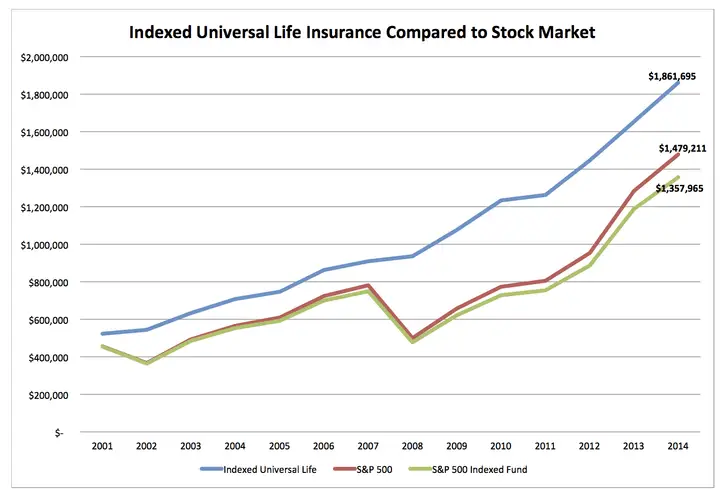

Suppose I told you that there was a product that could aid Americans to get term and spend the distinction, all with a solitary acquisition? Below is where I get simply downright kooky. View closelyHave you ever before examined how indexed universal life (IUL) insurance practically functions? It is a sort of money value life insurance coverage that has a versatile premium payment system where you can pay as high as you would love to accumulate the money value of your policy extra promptly (based on certain limits DEFRA, MEC, TEFRA, and so on). group universal life insurance cash value.

Latest Posts

Iul L

Best Iul Policies

Financial Foundation Iul